Apply Today

The Harris County Housing Finance Corporation’s Homebuyer Application asks for information about who is living in the household, all sources of household income, consumer debt, savings and assets, credit history, current living situation and homeownership goals.

Please have supporting documents such as paycheck stubs, benefit award letters, personal income tax returns, a copy of your credit report, and bank statements available for reference when you are filling out the application.

As of July 17, 2024 Harris County Community Land Trust is no longer accepting applications.

Application Process:

- Fill out the pre-application so that a CLT representative can provide you with more information.

- To complete the ARPA Single Family Acquisitions Application (if you're acquiring a home from our portfolio), CSD ARPA CLT Single Family Acquisitions Application.

- Our Program Specialists will review the applications and documents submitted.

- Attend a homebuyer counseling session with a HUD-approved counseling agency.(CLICK HERE)

- Meet with an approved lender to get pre-qualified for mortgage financing. Your credit risk and overall creditworthiness will be assessed based on the mortgage underwriting guidelines of the available lending programs.

- Your application will be reviewed and either approved or denied by HCCLT staff and the board of directors. If denied, you may receive tips on improving your qualifications.

**If approved for the HCCLT Program, start looking for a home with a realtor.

**If approved for the ARPA Single Family Acquisitions program, a CLT / ARPA Staff member will assist you in finding a suitable home from our portfolio.

- Sign a purchase and sale agreement with the Harris County Housing Finance Corporation.

- Apply for your mortgage through the approved lender.

- Schedule a call with HCCLT for a comprehensive review of the HCCLT Lease and other legal documents.

- Close on your new home and move in!

Requirements:

- The CLT homebuyer must contribute $500 of their own funds towards the down payment or closing costs.

- Household income contributors must be U.S. Citizens or hold a valid "Green Card" as proof of permanent residency in the United States.

- Liquid assets must not exceed $15,000.

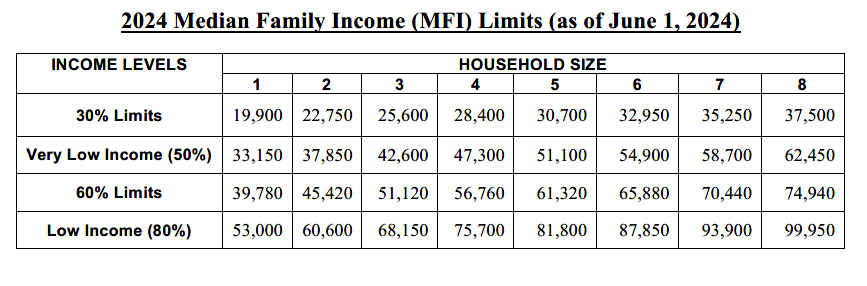

- Annual income should be at or below 80% of the area median income (AMI).

- Debt-to-income ratio: The front-end ratio (mortgage payment to income) maximum is 35%, and the back-end ratio(debts and mortgage payments to income) maximum are 42%.

- Completion of HUD-approved homebuyer education is mandatory.

- All mortgage applicants must have an average combined credit score of 620 (subject to change). Retirement, annuities, and bonds are excluded.

For any other questions, please reach out to info-harriscountyCLT@csd.hctx.net. Thank you!

Click here to learn more about debt-to-income ratios.

Note: the front-end ratio (mortgage payment in relation to income) should be a maximum of 35%

back-end ratio (debts AND mortgage payments in relation to income) should be a maximum of 42%

https://www.consumerfinance.gov/ask-cfpb/what-is-a-debt-to-income-ratio-why-is-the-43-debt-to-income-ratio-important-en-1791